Content

- Getting the Most from Payroll Services for Small Businesses

- Processing Payroll

- Deel makes growing remote and international teams effortless. Ready to get started?

- Outsource payroll to an EOR or a PEO for a full-service employment solution

- Choose your pay period wisely

- Managing Payroll: Tips on How to Do Payroll for a Small Business

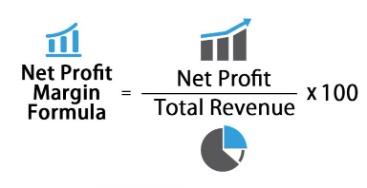

Subtract the following payroll deductions to arrive at net pay, which is the amount your employees see on their paychecks. Business owners looking to reduce the time spent on payroll by half should implement an organized payroll management system. Get our https://quick-bookkeeping.net/ newsletter for updates on today’s latest issues impacting business owners, including insider reports & special offers. All you need to do is connect both platforms to Synder, do the mapping, and get your employees’ data automatically updated across them.

- On the other hand, when you are adding an additional employee to the payroll, the procedures will not vary drastically from your regular processes.

- In order to be able to do this, you need to have the necessary information about your employees.

- All you need to do is connect both platforms to Synder, do the mapping, and get your employees’ data automatically updated across them.

- So your ideal software is part of a bigger system rather than a disjointed element.

- Many or all of the products here are from our partners that compensate us.

Employers withhold income taxes from employee paychecks.Withholding amount is based on each employee’s total wages and the latest IRS Form W-4 the employee completed. Most states require firms to issue payment statements to employees at the moment they receive their earnings for the sake of transparency. For each pay period, the rates of pay, hours worked, gross pay, net pay, and deductions must all be represented. Other restrictions control how electronic pay statements are delivered and accessed by employees.

Getting the Most from Payroll Services for Small Businesses

And as your business continues to grow, consider expanding the role and creating a dedicated payroll team. You need to track federal income tax, Medicare, and Social Security tax for each employee. Having these records in A Small Business Guide To Payroll Management place will make it easier when filing taxes because you must indicate in detail what has been withheld. Doing payroll manually is the least expensive option, and about 25% of small businesses take this low-cost approach.

If your business is consistently out short when it’s time to pay your employee, you may want to examine your cash flow to identify the source of the problem. According to a study, 80% of small businesses fail due to cash flow problems. Monitoring your cash flow will aid you in detecting and preventing any potential payroll issues such as overpayment or overstaffing.

Processing Payroll

Moreover, timely payroll reduces the risk of underpaying or overpaying employees. Set reminders on your phone or calendar 2-3 days before the payroll is due. Keep in mind that direct deposits have a 2-day lead time, meaning you need payroll entered and submitted by Wednesday to meet a Friday pay date.

Know the difference between employee’s and independent contractors. To be safe, keep all payroll documents for at least seven years. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation.

Deel makes growing remote and international teams effortless. Ready to get started?

The job of Synder is to act like a bridge, bringing all your data into one place, and seamlessly synchronizing information across different channels. Getting outside assistance is more suitable if you can’t afford a full-time specialist yet, but need someone to handle the end-of-month payroll calculations. Usually, this option can be more beneficial for small companies with few employees. Usually, in-house payroll specialists are also responsible for the overall HR, as these tasks intersect.

Every business and industry has unique needs and requirements from its payroll service. However, you may consider a payroll service provider capable of offering the following features at a minimum. Once you gather the hours worked, you will enter them into your payroll system or manually calculate the pay. Payroll taxes will need to be withheld from your employee’s pay depending on their withholding levels and applicable wage and hour laws. Gusto is suitable for small businesses that plan to stay small since it eliminates the need for an HR department altogether. It’s also more affordable than most payroll service providers.

Strong employees can find work elsewhere, so it’s important to retain your team and make sure their pay is always done correctly and on time. Gusto’s full-service payroll, HR, and benefits platform enables you to schedule automatic recurring payroll. To process those deductions, add up all the deductions for each employee to get a total; then subtract that total from the employee’s gross pay. Alternatively, you can list each deduction as a line item and subtract them one by one from the employee’s gross pay until you come up with a net pay amount. You’ll use the data on the forms described below to add the employee to your HR or payroll system if you have one. It’s a good idea to store this information as a paper document or an electronic personnel file.

- For those small business owners, we recommend trying QuickBooks Payroll.

- When managing payroll, your primary partner is software, as no business owner should really calculate salaries, deductions, and taxes manually.

- Our frequently asked questionscan help you understand the basics of payroll.

- However, knowing what to look for can be challenging, and it can be tempting to choose based on price alone.